Bank reconciliation statements are effective tools for detecting fraud, theft, and loss. For example, if a check is altered, the payment made for that check will be larger than you anticipate. If you notice this while reconciling your bank accounts, you can take measures to halt the fraud and recover your money. An NSF (not sufficient funds) check is a check that has not been honored by the bank due to insufficient funds in the entity’s bank accounts. This means that the check amount has not been deposited in your bank account and hence needs to be deducted from your cash account records.

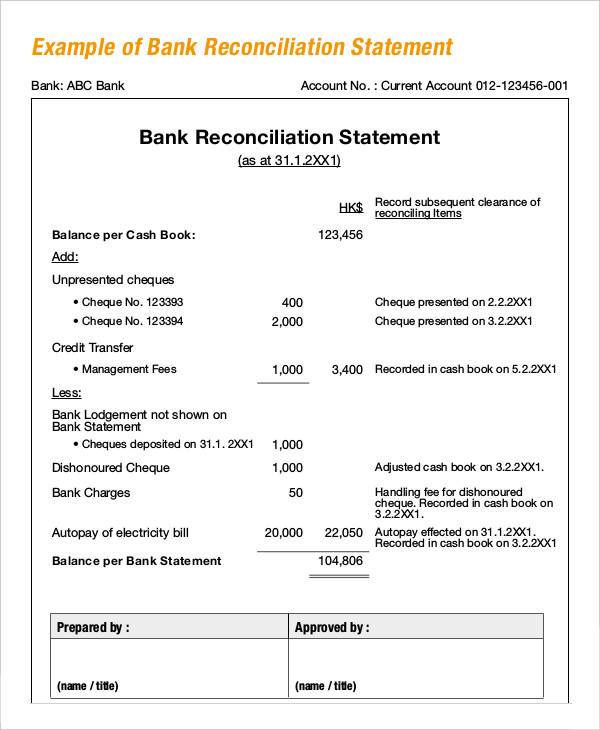

Example #2 of Bank Reconciliation Statement Template

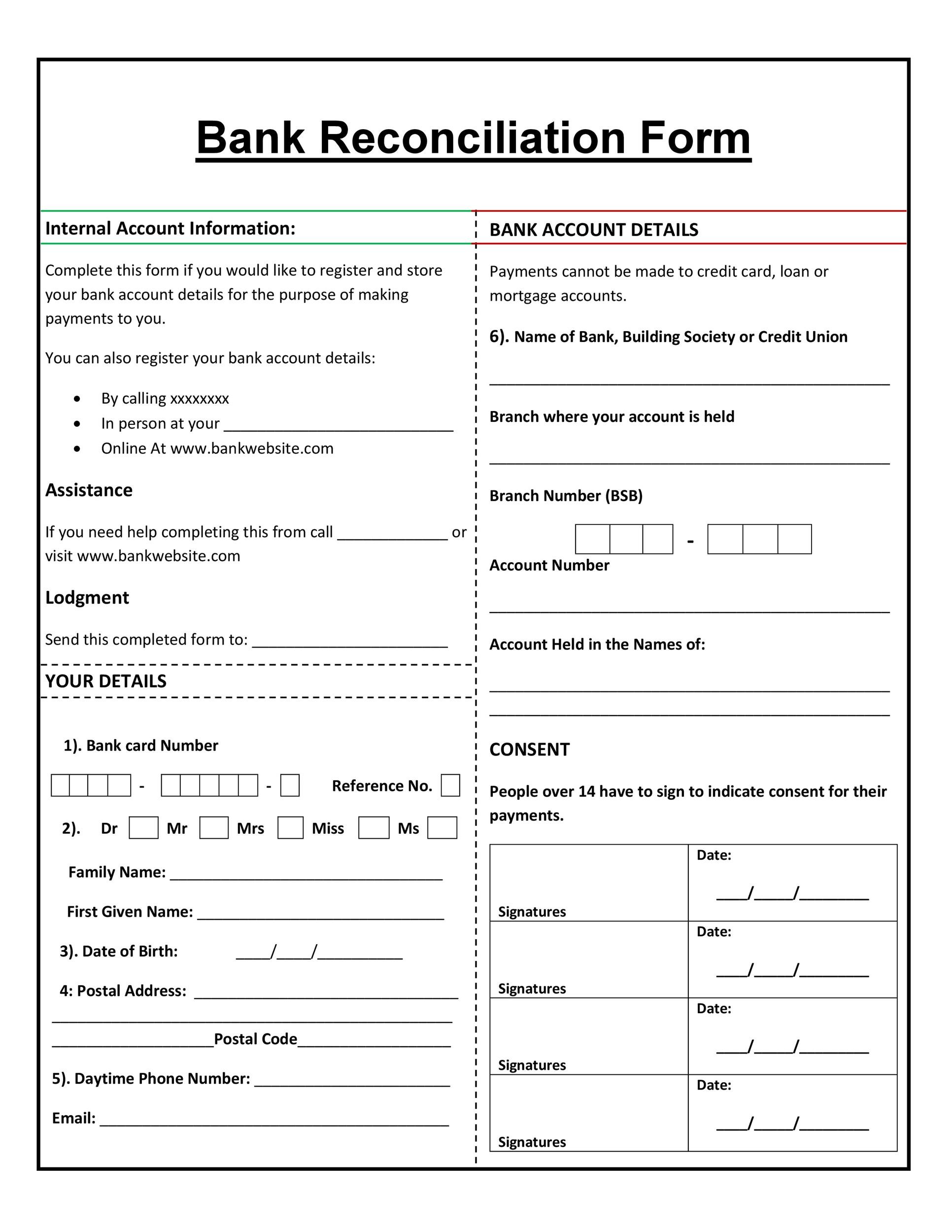

- Once you have identified all the differences between the two statements, identify the source of the discrepancy.

- If you work with a bookkeeper or online bookkeeping service, they’ll handle it for you.

- Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books (even though your bookkeeping shows you got paid).

- Begin by aligning the bank account balance with the cash balance on your company’s balance sheet.

- If you detect incorrect amounts or an omission in your books, you also need to correct those transactions so your records match the bank statements.

- The statements give companies clear pictures of their cash flows, which can help with organizational planning and making critical business decisions.

Bank usually deducts charges from depositor’s account for such services and intimates him or her about these deductions by issuing a debit memorandum. Find if there exists any debit memorandum that have not been recorded in your accounting record. As of 30 September 20XX, the ending debit cash balance in the accounting records of Company A was $1,500, whereas its bank account showed an overdraft of $500.

Bank Reconciliation Process FAQs

Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records. Before you reconcile your bank account, you’ll need to ensure that you’ve recorded all transactions from your business until the date of your bank statement. If you have access to online banking, you can download the bank statements when conducting a bank reconciliation at regular intervals rather than manually entering the information. When all these adjustments have been made to the books of accounts, the balance as per the cash book must match that of the passbook. If both the balances are equal, it means the bank reconciliation statement has been prepared correctly.

Sample of a Company’s Bank Reconciliation with Amounts

Bank reconciliation is a simple and invaluable process to help manage cash flows. The deposit could have been received after the cutoff date for the monthly statement release. Depending on how you choose to receive notifications from your bank, you may receive email or text alerts for successful deposits into your account. Contact your bank to investigate further and find where the issue lies. Once solved, be sure to adjust your records to reflect deposits as needed.

Accounting for these delays is key to reconciling the total amounts on the company’s financial statement and the bank statement. Bank charges are service charges and fees deducted for the bank’s processing of the business’s checking account activity. This can include monthly charges or charges from overdrawing your account. If you’ve earned any interest on your bank account balance, it must be added to the cash account. Bank reconciliation is the process of matching a company’s cash records with bank statements to identify discrepancies and ensure accurate financial records. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows).

On the other hand, a small online store—one that has days when there are no new transactions at all—could reconcile on a weekly or monthly basis. Hopefully you never lose any sleep worrying about fraud—but reconciling bank statements is one way you can make sure it isn’t happening. If, on the other hand, you use cash basis accounting, then you record every transaction at the same time the bank does; there should be no discrepancy between your balance sheet and your bank statement. When done frequently, reconciliation statements help companies identify cash flow errors, present accurate information to investors, and plan and pay taxes correctly. They can also be used to identify fraud before serious damage occurs and can prevent errors from compounding. Bank reconciliation statements are tools companies and accountants use to detect errors, omissions, and fraud in a financial account.

These may include deposits in transit, outstanding checks, bank fees, or miscalculations by the bank or the internal accounting team. Match the deposits in the business records with those in the bank statement. By comparing your company’s internal accounting records to your bank statement balance, you can confirm that your records are accurate and analyze the reasons behind any potential discrepancies. Notice that there are no journal entries posted for the bank statement adjustments (Step 1) because those are only used in the reconciliation process to calculate at the “correct” adjusted cash balance. A company’s receipts that appear on the company’s records but do not yet appear on the bank statement. For example, a retail store’s receipts of March 31 are deposited after banking hours on March 31 or on the morning of April 1.

Those receipts are in the company’s general ledger Cash account on March 31, but are not on the March 31 bank statement. On the bank reconciliation a deposit in transit is an adjustment (an addition) to the balance per bank. For teams looking to move away from a manual reconciliation process, close automation accounting software is key. Some businesses, particularly those with high-volume financial transactions, may benefit from weekly or even daily ongoing reconciliations. This practice ensures any errors or fraudulent activities are caught early.

In other words, Adjusted balance per BANK must equal Adjusted balance per BOOKS. Make a list of these items as they will need to be accounted for to reconcile the balances. An asset account in a bank’s general ledger that indicates the amounts owed by borrowers to the bank as of a given date. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. (b) Checks Nos. 789 and 791 for $5,890 and $920, respectively, do not appear on the bank statement, meaning these had not been presented for payment to the bank by 31 May. (a) Deposits made by Sara Loren on 30 May, $1,810, and on 31 May, $2,220, have not been credited to the bank statement.

In accounting, a company’s cash includes the money in its checking account(s). To safeguard this critical and tempting asset, a company should establish internal controls over its cash. To create a bank reconciliation, you will need to gather your bank statements and reconcile them with your accounting records (ledger). A bank reconciliation statement is a document that is created by the bank and must be used to record all changes between your bank account and your accounting records. It shows what transactions have cleared on your statement with the corresponding transaction listed in your journal. The company reflected the payment it received from debtors in its cashbook, but the payment hasn’t yet reflected in the bank account.

She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn. Since the notification had not been received, it was necessary to put this item on the leading safe 5 0 exam questions and answers pdf reconciliation. The usual procedure calls for the bank to send the depositor not only the notification but also the check itself. The reconciliation prepared by the accountant appears in below example. Direct debit payments of $500 automatically deducted from the account.