But if you want to know the exact formula for calculating reverse sales tax then please check out the “Formula” box above. This sales tax decalculator template will help you calculate the pre-tax price of a good or service when the total price and tax rate are known. Accounting software like QuickBooks Online provides several benefits that enhance efficiency and accuracy.

Accounting Crash Courses

When you purchase goods, you may wonder how much these items actually cost before the sales tax gets added to them. Either that or you may want to check the accuracy of the sales tax indicated on your item’s receipt. Fortunately, you can get this amount easily using this reverse sales tax calculator. This is a very useful tool, especially if you itemize deductions and then claim any overpaid sales taxes. Just remember to keep all of your receipts if you plan to claim these overpaid taxes from the items you’ve purchased.

Sales tax calculator: How to calculate your sales tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax.

Who has to collect sales tax?

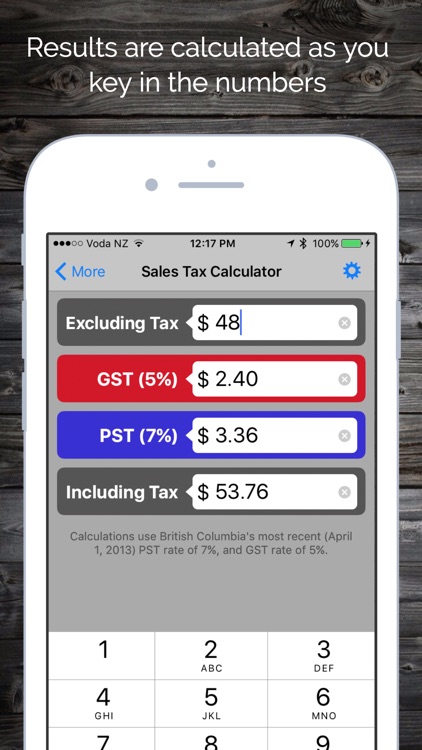

All you have to input is the amount of sales tax you paid and the final price on your receipt. If you overcharge sales tax, you should refund the excess amount to the customer as soon as possible. For example, for the sales tax you collect in April, the due date for filing and paying sales tax will likely be around May 20th. Depending on the amount of taxes you owe, your filing and paying frequency might be less frequent.

Step 2: Click the “Get rate estimate” button

For more details and up-to-date information, you may have a look at the official website of Streamlined Sales Tax Project. All content on DashCalculator.com is the exclusive property of DashCalculator.com. The collection and assembly of content on this Site are the exclusive property of and are protected by copyright and other intellectual property laws. Take your learning and productivity to the next level with our Premium Templates. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentations, and Word document templates.

How To Calculate Reverse Sales Tax In the USA

Generally, if a business has a physical presence or nexus in a particular state, such as a store, office, or warehouse, it must collect sales tax on taxable transactions made in that state. Since the sales tax amount can vary within the same ZIP code, we recommend entering a complete street address to calculate your total tax amount as accurately as possible. This could be something to consider if you live in a state where sales tax is relatively high and you happen to have made a lot of taxable purchases of goods and services.

On the other hand, VAT tends to be regressive; that is, it takes proportionately greater amounts from those with lower incomes. Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. For more information about or to do calculations involving VAT, please visit the VAT Calculator.

- The amount of sales tax you pay depends on the state where you made your purchase.

- VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries.

- All you have to input is the amount of sales tax you paid and the final price on your receipt.

- The buyer pays the sales tax, but you, as the seller, collect it.

In addition, in 38 states, an additional local sales tax is collected. A 1979 study published by the Tax Foundation offered some insight into arguments for or against VAT as compared to sales tax. Perhaps the greatest benefit of taxation via VAT is that because taxation applies at every step of the chain of production of a good, tax evasion becomes difficult. Also, there are stronger incentives to control costs when all participants involved in a supply chain are taxed. Compared to sales tax, VAT has the ability to raise more revenue at a given rate.

Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food. It is an indirect sales tax applied to certain goods and services at multiple instances in a supply chain. Taxations across multiple countries that impose either a “GST” or “VAT” are so vastly different that sales tax decalculator formula neither word can properly define them. The countries that define their “sales tax” as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia. If your total receipt amount was $57.98, and you paid 1.07 percent in sales tax, you’d simply plug those numbers into our calculator to find out that your original price before tax was $57.37.